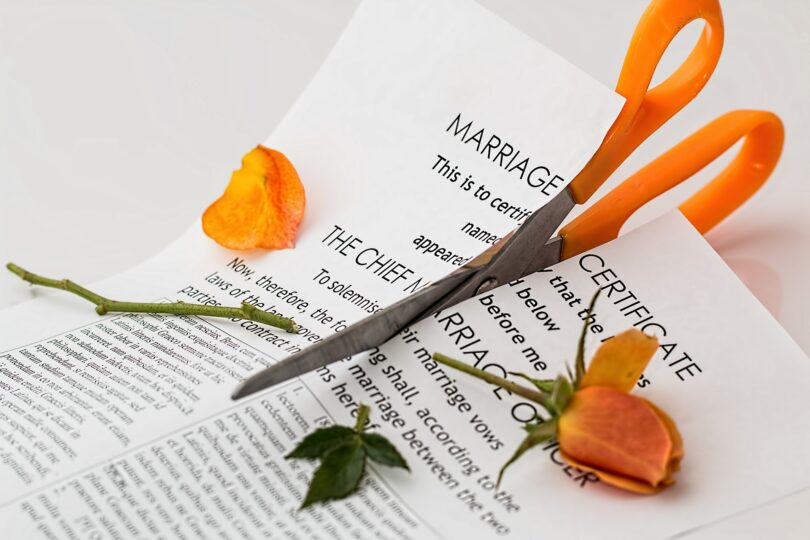

Divorce not only makes a person suffer emotional loss but it can also make them suffer financially. Divorce generally involves the distribution of resources such as houses, cars, bank accounts, securities, and retirement funds. In some cases, another resource exists money, which can have significant value.

One of the spouses may be tempted to hide the money if they know about it. “How to hide money in a divorce?” You might think this does not happen very often but that is not the case. Money can be hard to trace.

Also Check: Threatening Divorce in a fight

How to hide money in a divorce?

You may think there are only a few ways to hide money in divorce. Think again, there are many ways to hide money or assets. These can include hidden bank accounts to overpaying the IRS or credit cards.

People hide money in their divorce in many countries. Australia is one of them. How to hide money in a divorce Australia? Here are 3 ways an ex-partner can hide money from you.

Also Check: What Are You Entitled To In A Divorce Settlement?

Keeping money into trust or your children’s accounts

It is often thought that depositing money in a trust can protect the money from family law proceedings. However, this is a misconception as part of the rule of full and frank disclosure, trust activities must be disclosed. An alternative to this can be the transfer of money from your account into your children’s account. In this case the ex-spouse will not have command over that account.

Limiting individual income

An ex-spouse can limit their own income during divorce proceedings, to exhibit that they do not have high amounts of funds. By doing this he or she can avoid a larger compensation on spousal maintenance or child support. Deferring the salary or bonuses are a few techniques people may use to limit their income.

Reducing financial balance

To limit their financial balance an individual may buy costly items which can be resold after the settlement. This can also include buying gift vouchers which can be refunded or spent later on buying items. Another procedure is “loaning” cash to family, companions other trusted people. Who would then be able to return the cash back later after settlement.

Also Check: If You File For Divorce Can You Stop It?

What happens if you hide money in a divorce?

Early on in the divorce proceedings both spouses are required to fill out a financial declaration. This reveals all kinds of revenue and financial resources. Each party is swearing to tell the truth that what they complete is precise by signing this disclosure. Inability to reveal monetary information in divorce can lead to penalties.

Penalties range from accepting a smaller share of the marital assets to paying the lawyer’s expense of the other party. In 2014, the penalty for hiding assets in divorce South Africa was given in a case. The husband had to pay an amount of R 6.4 million.

As well as to transfer half of a loan account of approximately R 11 million to his wife. Furthermore, the courts ordered the husband to pay for the cost of appeals.

Just like South Africa the UK also imposes the same penalties. The penalty for hiding assets in divorce UK consists of being ordered to pay the lawful expenses of the other party. Moreover, the person hiding the assets may receive a less favorable monetary settlement than they would have been granted otherwise.

Also Check: Why do couples divorce when they are empty nesters?

How can I protect my money in a divorce?

During divorce settlements a full and frank disclosure is required for financial assets. Here are few of the best ways to hide money legally from your spouse. They also fulfill the full and frank disclosure requirement.

Open accounts in your name only

Many legal counselors advise freezing or shutting joint bank accounts as well as credit card accounts. They advise this so that you are not answerable for purchasing by your ex-spouse.

Take stock of resources and debts

With your lawyer’s assistance request a full disclosure of all joint and individually owned financial assets. This will help you in keeping track of where your money is and goes.

Change your will

Alter your will appropriately as you plan for a divorce or, quickly upon its settlement. Most states prohibit ex-spouses from serving as trustees. Furthermore, they also do not allow them to receive under your will.

Also Check: My Wife Is Cheating On Me And Wants A Divorce

Can you hide bank accounts in divorce?

In the UK couples are required to provide a full revelation of all their resource. These include wage, property, capital and pension both within the UK and abroad. However, many people tend hide their money during or before divorce proceedings. How to hide assets before divorce UK?

The disclosure of financial resources is done on the ‘Form E’ which asks questions about all aspects of an individual’s finances. If later on it unfolds that a spouse intentionally omitted information such as a hidden bank account. The spouse can be fined or even jailed as it is illegal to hide assets during a divorce.

Also Check: How to stop a divorce after filing?

Can I empty my personal bank account before divorce?

The answer to this depends on whether the personal bank account contains marital property or not. If a couple open their separate accounts after the marriage began, than the accounts must be equally divided. If a personal account contains martial funds it belongs to the marriage. Both the parties are entitled to it.

When it comes to making a decision about who ‘owns’ the account, the name on the account is not important. The accounts are looked at by the courts in two ways: marital property and non-marital property. Martial property is split equally while non-marital property is awarded to the person who is judged as its sole owner.

Also Check: Does legal aid help with divorce?

Is my wife entitled to half my savings?

With regards to marriage and separation, the word “individual” loses quite a bit of its significance. The courts hardly care whose name is on the savings account or how a resource is named. What they really care is how the account began and how it was used.

In divorce there are two categories where all resources fall into. Either your savings account is your separate property or the property of the marriage.

If the account was opened before you got married it is considered separate property. Or if you inherited the funds or they were given to you as a gift by someone. The account is considered marital property if it is opened after the marriage and you contribute to it. It does not matter if it is only opened in your name.

Therefore, it can be said that your wife will not be entitled to half your savings if they are your sole property.

Also Check: Divorce rate after death of a child

Takeaway

Divorce can be hard on an individual or both partners as they go through emotional and financial challenges. If you are the spouse facing financial difficulties you would want to know “How to hide money during a divorce?” There are certain ways to do it but there are consequences to it as well.

Remember hidden assets in a divorce are discoverable and in case that happens you may face penalties and even lose what you had.

Also Check: Can you cancel divorce once initiated?